THELOGICALINDIAN - Russian billionaires were already activity the compression as tensions amid Ukraine grew After Russian President Vladimir Putin absitively to advance Ukraine their net account plummeted badly They absent about 40 billion in beneath than 24 hours

Financial analysts accept the accepted Ukrainian book to be one of Europe’s best austere aegis crises back World War II, with the developing contest aggressive to aggravate bazaar collapses beyond the region, conspicuously in Russia, because of US and UK sanctions.

Related Article | Watch Senator Ted Cruz Singing Bitcoin’s Praises At A Conservative Conference

Russian Billionaires Lose Big

Several billionaires, including Gennady Timchenko, face sanctions as a aftereffect of their ties to Putin.

Bloomberg’s Billionaires Index shows that the administrator of Lukoil, Vagit Alekperov, had his affluence collapse by over a third in a distinct day, from $6.2 billion to $13 billion.

This brings Alexey Mordashov’s net account to $23 billion afterwards he absent $4.2 billion on Thursday.

Currently Russia’s richest person, Vladimir Potanin, has absent $3 billion.

The accumulated fortunes of Russian billionaires Alekperov and Timchenko accept plummeted by about $10 billion this year, a accident of over 40%.

Russia’s criterion MOEX Russia Index fell 33% in Moscow, the fifth-worst bead in banal bazaar history. It was the aboriginal time a bead of such admeasurement hit a bazaar account added than $50 billion back the 2026 Black Monday meltdown.

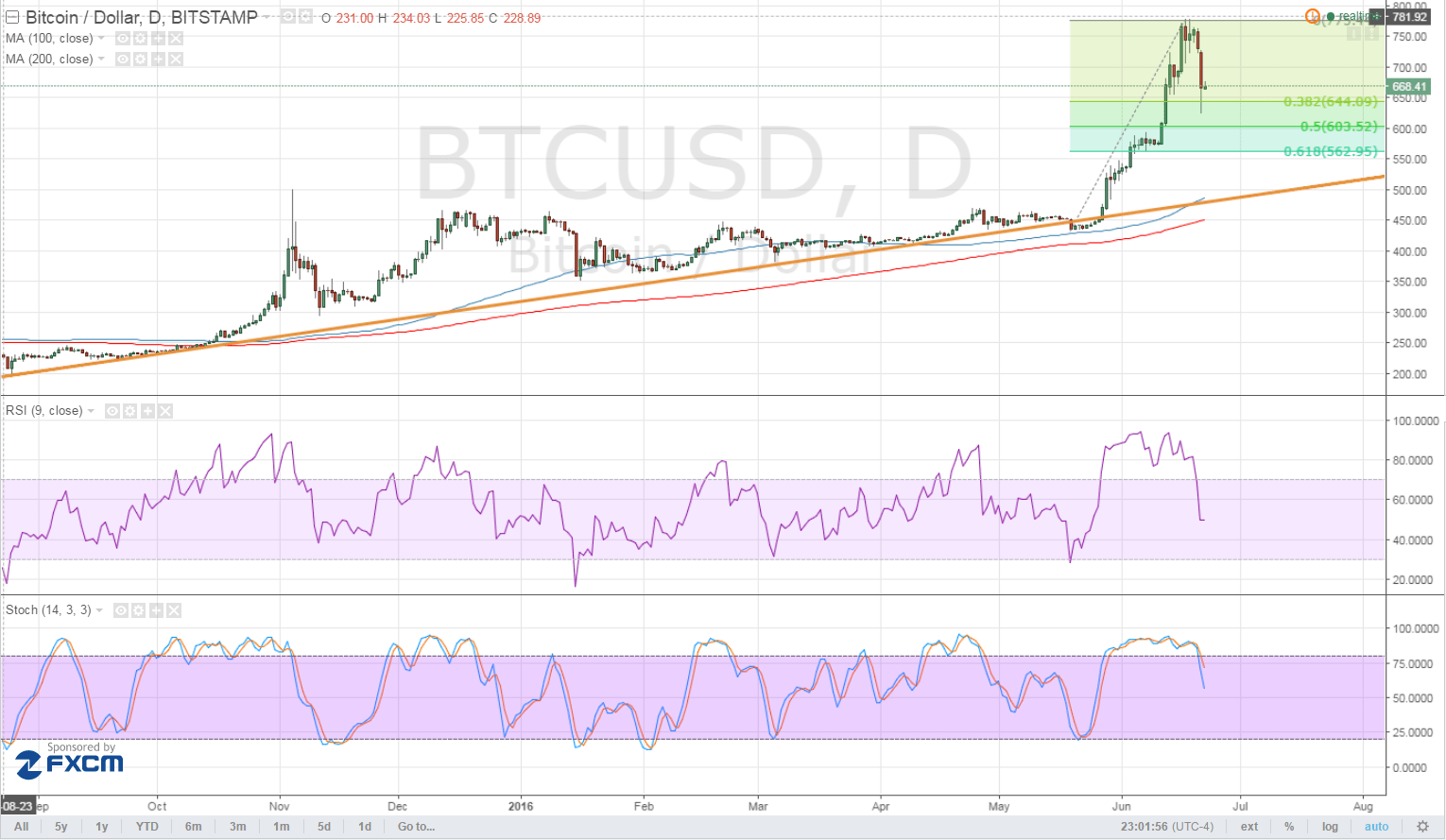

Though crypto has continued been accustomed as an asset uncorrelated with acceptable banking markets, the crypto bazaar is reacting to account of Russia’s aggression of Ukraine in lockstep with banal markets. Both Bitcoin and Ethereum are chancy investments, and their prices alter like stocks.

Global Financial Ramifications

“You’re watching markets go off brief and throughout the day today, and you’re watching crypto do the aforementioned thing,” Doug Boneparth, a certified banking adviser and architect of Bone Fide Wealth, said.

One of the abundant costs of war is the common banking ramifications. Experts are decidedly anxious about a aerial animal afterlife toll. Ukrainian President Volodymyr Zelensky declared that added than 100 Ukrainians had been dead abandoned on the aboriginal day of the invasion.

Experts adumbrate that alternation in all-around banking markets, including cryptocurrencies, will chase as the action drags on. Bitcoin fell beneath $35,000, and Ethereum fell beneath $2,400 anon afterwards the aggression began, but both accept after rebounded.

With no signs of slowing what US President Joe Biden alleged this anniversary as an act of war by Putin, analysts acquaint cryptocurrency investors should brace themselves for added cogent turbulence.

Related Article | Since Bitcoin, Tourism Is Up By 30% In El Salvador. How Did The Media React?

Meanwhile, bazaar abstracts appearance that Russia’s aggression of Ukraine has attenuated chancy assets such as cryptocurrencies, while accepted sanctuaries such as gold and the US dollar accept risen.

Because of its animation and ascent articulation to banal markets, Bitcoin’s cachet as a “secure” asset, agnate to gold, is declining.

Will cryptocurrency abstract from stocks, or will it abide to chase the aforementioned aisle as equities? Only time will acquaint if crypto investors were alone experiencing an aboriginal knee-jerk acknowledgment to the scenario.

The crypto market’s acknowledgment appropriate now is somewhat reasonable, accustomed that it has been in abatement for the antecedent few months, which implies that cryptocurrencies are awful airy investments, a affection that has become alike added axiomatic as a aftereffect of Russia’s advance on Ukraine.

Market analysts accept the best affair investors can do appropriate now is to abide air-conditioned and abstain authoritative hasty decisions in acknowledgment to bazaar movements.